The race is on for minerals critical to the green economy. From Moneyweb.

BHP’s aborted bid for Anglo American – particularly its appetising copper assets in South America – is a foretaste of what’s to come in mining.

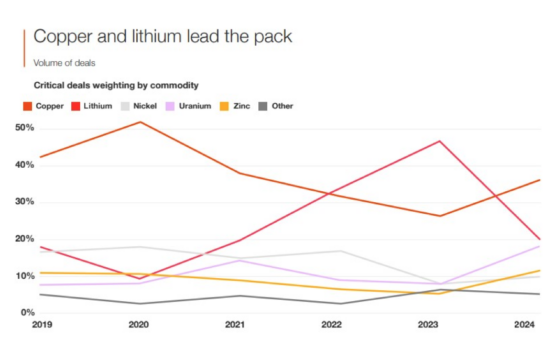

There is a global scramble for critical minerals among the Top 40 miners, with copper and lithium dominating the deal-making in 2023, according to the PwC Mine 2024 report released on Tuesday.

It’s no surprise that gold, now surging above $2 300/oz, was the focus of intense deal-making worth $21 billion (R382 billion) last year, according to S&P Global. Copper and lithium – two essential ingredients in the green economy – have emerged as power players in the mining M&A space.

Lithium companies are underrepresented among the Top 40 miners because they are often classified as chemical producers. Lithium investments are generally less capital-intensive and have shorter repayment periods than other metals and minerals critical for the energy transition.

The expected growth in lithium demand has fuelled intense M&A activity in recent years.

Commodity prices have fallen over the past five years while mining production costs have increased 30%, and that is powering the hunt for productivity enhancements through the use of renewable energies, AI, and automation.

Mega deals

S&P Global tracked 47 mega deals in 2023 – 30 focused on gold, 14 on copper and three on nickel, for a total deal value of $26.4 billion (R480 billion).

Using a broader measure, PwC notes a 15% drop in the number of deals among the Top 40 miners in 2023, while the total value increased 35% to $64 billion (R1.16 trillion).

“The percentage of completed mining deals involving the Top 40 that were focused on critical minerals rose to 40% in 2023 from 22% in 2019, underlining this seismic shift driving M&A activity. Copper and lithium dominated such deals, accounting for over 70% of them by volume, up marginally from 2022,” says PwC’s 2024 mine report.

The scramble for critical minerals pushed copper and lithium to the top of the deal list in 2023, with consolidation remaining a dominant theme as miners reconfigure their asset portfolios and refine their future business direction.

Read:

Buried fortune of old copper wire is worth billions to telcos

After massive bust, global lithium market shows signs of life

Cluff Africa agrees to develop Zimbabwe lithium mine

In November 2023, the largest deal in the gold sector was announced when Newmont acquired Newcrest for $14.5 billion (R264 billion). Facing the prospect of flat annual production over the next decade, the Newcrest acquisition expands Newmont’s portfolio by adding five operating mines and two advanced-stage projects, while also enhancing its copper exposure. Following this acquisition, Newmont announced plans to divest eight non-core assets.

Copper and lithium accounted for more than 70% of critical mineral deals in 2023, marginally higher than 2022.

Copper accounted for more than 80% of the total value of critical mineral transactions, says PwC.

In one of the biggest deals of 2023, Chinese miner MMG acquired Cuprous Capital, the parent company of the Khoemacau Copper Mine in Botswana, for $3.6 billion (R65.5 billion). The transaction aligns with MMG’s strategy of building a portfolio of high-quality mines that can supply the minerals most important to a decarbonised world.

The growth of recycled minerals

Another driver of M&A is the energy transition, with Rio Tinto acquiring 50% of the Giampaolo Group’s Matalco recycled aluminium business, and Brazilian group Vale’s 45% acquisition of Aliança Energia for $540 million (R9.8 billion), which adds hydroelectric and wind generation to Vale’s portfolio.

Partnerships

Another emerging trend is mining partnerships and joint ventures.

“Mining companies are increasingly seeking alliances beyond traditional sector boundaries, as their view of the ecosystem broadens. These strategic moves are driven by the need to access capital; integrate new skills in highly specialised areas, such as technology and sustainability; and work more closely with government,” says PwC.

An example of this is Rio Tinto’s partnership with Japan’s Sumitomo and the Australian Renewable Energy Agency to explore the use of renewable hydrogen to refine aluminium

Revenues falling

PwC reports that revenues from the Top 40 miners dropped 7% in 2023 despite increasing production of key commodities. These trends are likely to continue in 2024, marking the first time since 2016 that industry revenues will fall for a second consecutive year.

“Investors are not interested only in the current bottom line, but want insight into how a company will perform and what it will look like in the future,” says Andries Rossouw, PwC Africa energy, utilities and resources leader.

Mining companies are forming alliances beyond traditional boundaries as they seek the technical skills they lack and are also collaborating with governments to create these enabling environments.