It was 5% in 2009 – then came the gutting of Sars under Tom Moyane and the devastating impact of the Covid ban on cigarette sales. From Moneyweb.

South Africa’s cigarette market will be studied by organised crime syndicates for decades to come as a blueprint for market capture.

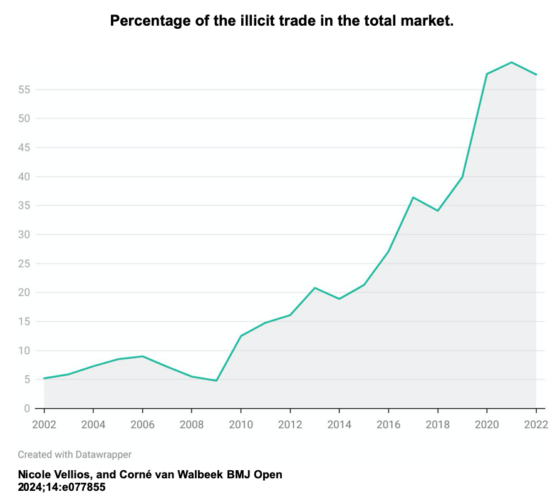

“The illicit cigarette market comprised 5% of the market in 2009, peaked at 60% in 2021, and decreased to 58% in 2022,” says a new study out of the University of Cape Town.

Read:

Tobacco ban unconstitutional and invalid [Dec 2022]

Dlamini-Zuma found to have infringed rights ‘foundational to a democracy’ [Jun 2022]

Illicit trade is sucking R100bn a year out of SA [May 2023]

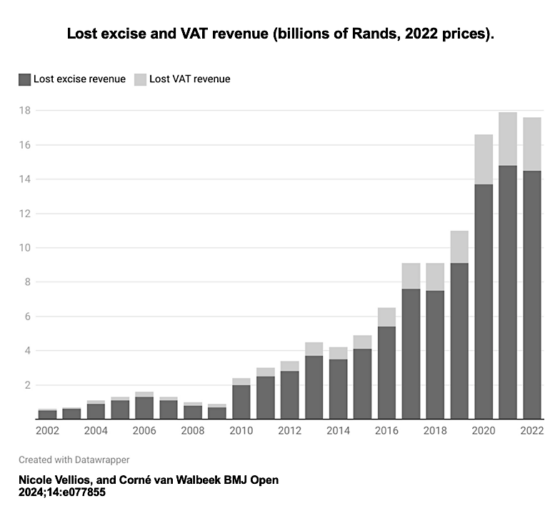

In 2022 alone, the government lost R15 billion in excise and R3 billion in value-added tax (Vat) from these illicit sales.

From 2002 to 2020, the revenue lost to the fiscus was a staggering R110 billion. Had the South African Revenue Service (Sars) collected its fair due in 2022, it would have added another 1% in total government revenue to the actual 0.6% received.

What happened between 2009 and 2020 to account for this extraordinary windfall for the criminals?

Two events stand out:

- The five-month ban on tobacco sales in 2020 during Covid, which gifted the cigarette market to criminals as smokers switched to cheaper brands when their regular brands were unavailable; and

- The gutting of Sars under Tom Moyane, commencing around 2014, which resulted in a reduced capacity to collect excise on cigarettes.

In 2005, British American Tobacco (BAT) was reckoned to have 91% of the local tobacco market.

Other multinationals such as Philip Morris and Japan Tobacco International then entered the market, followed by smaller manufacturers such as Gold Leaf Tobacco, attracted by high profits being made by the incumbents.

The big players used the annual increase in excise to increase the retail prices of cigarettes, thereby increasing their profit per cigarette.

Many of the cigarettes produced by the new entrants started selling at prices that did not even cover the cost of the excise, and that practice continues to this day.

This is reflected in the graph below, showing a sharp increase in the illicit market from about 2009.

The 60% market share captured by illicit cigarettes corresponds with recent estimates by the tobacco majors such as BAT and Philip Morris, with some suggesting the black market is as high as 70%.

Expressed another way, legal cigarette sales on which taxes were paid accounted for about 14.3 billion sticks in 2022, against 19.4 billion illicit sticks.

Read: Philip Morris is saying goodbye to cigarettes

An illicit pack of 20 cigarettes sell for anything from R15 to more than R50. The excise on the pack is R21.77, which means anything selling for less than about R32 is probably illegal, say the authors of the report, Nicole Vellios and Corné van Walbeek.

Quite apart from the loss to the fiscus is the impact on health. Nearly 30% of South African adults are smokers – with men running at more than double the number of women – according to 2021 data from the South African Medical Research Council.

The number of smokers appears to be increasing, contrary to trends elsewhere in the world.

There is no doubt that the cheapness of cigarettes, flooded with black market products, is a key reason for the high smoking prevalence rate in SA.

More people would have quit smoking or reduced their consumption if cigarette prices had been higher, says the UCT study.

Tax ineffective as tobacco control tool

Given the massive size of the illicit market, an increase in the excise tax becomes much less potent as a tobacco control tool, say the authors.

“An increase in the excise tax will have an impact on the price of legal cigarettes, while the price of illicit cigarettes is unaffected (unless illicit cigarette manufacturers increase retail prices),” says the study.

“Furthermore, the availability of illicit cigarettes makes it easy for smokers to switch to the illicit market,” it adds.

“In the past few years, South Africa’s National Treasury has increased the excise tax by roughly the inflation rate. The National Treasury may be waiting for Sars to contain illicit trade, which, to date, Sars has not been able to do, despite some gains.”

In 2022, Sars won a preservation order against Gold Leaf Tobacco, maker of the country’s most popular brand RG, as well as its directors Simon Rudland and Ebrahim Adamjee, to prevent the dissipation of assets as a way to frustrate the collection of taxes.

Gold Leaf Tobacco vowed to oppose the ex parte (where only one side’s evidence is argued) preservation order and argued that Sars was relying on the information of informants, and that it was not given an opportunity to present its side of the story to the court.

The company assured Moneyweb at the time that it operates with complete transparency and paid over R2 billion a year to Sars in excise and Vat.

Rudland explained to Moneyweb that the RG brand had become the country’s leading brand through the distortions introduced to the market by the 2020 tobacco ban.

Cigarettes were being legitimately purchased in Zimbabwe and smuggled across the border to SA, and that was not something the company could control.

Read: Sars intercepts truck smuggling illicit cigarettes worth R20m

It is unlikely that any excise or Vat is being paid on these smuggled or illicit cigarettes, and that situation continues today.

Given the massive loss of revenue to Sars, what’s to be done?

The UCT study provides some solutions: “Sars should secure the cigarette supply chain to monitor cigarettes from the point of production to the point of sale. The Protocol to Eliminate Illicit Trade in Tobacco Products provides guidelines for reducing illicit trade.

“South Africa has not yet ratified the Protocol. The Protocol commits governments to take effective steps to reduce the illicit trade in tobacco products, such as allowing only licensed manufacturers to produce cigarettes and implementing a track-and-trace system.

“If Sars does not secure the supply chain, South Africa will continue to lose valuable revenue.”