Gross gambling revenues are growing more than 25% a year as more South Africans admit to a gambling problem. From Moneyweb.

South Africa has a gambling problem, and it has exploded since the Covid-19 lockdowns.

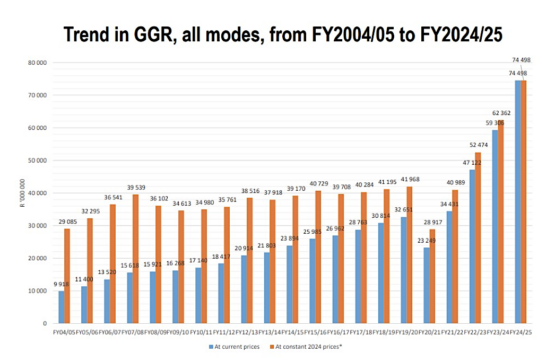

Just take a look at the graph below, which shows gambling revenues across all platforms relatively flat from 2005 to 2019. In 2020, during the Covid lockdowns, it dropped by 28% in current prices. It has since climbed 220%.

Read: Sunbet now more profitable than cash cow GrandWest

SA gross gambling revenue 2005-2025

Not shown in the chart is the shift in gambling habits:

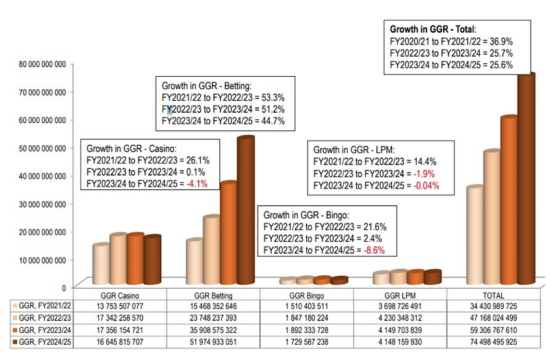

- Casinos (tables and slots) grew revenues by 26.1% in 2023, but has since gone into retreat, recording -4.1% revenue growth in the 2025 financial year;

- Limited payout machines (LPMs) grew revenues by 14.4% in 2023 but has also gone into retreat, with zero growth over the past year;

- Betting on horse racing, sport, and other contingencies (offered by bookmakers and totalisators, on- and off-course) grew revenues by 53.3% in 2022 and has more or less maintained that pace of growth since then, with a 44.7% increase in revenues in 2025; and

- Bingo (traditional and electronic bingo terminals) grew revenues by 21.6% in 2023 but slumped -8.6% in 2025.

Overall, gross gambling revenues have been growing at more than 25% a year since 2022, with most of this coming from betting popularised by companies like Betway and Hollywoodbets.

Growth in gross gambling revenue by gambling mode

These figures do not include gambling platforms registered abroad, so the figures are likely higher.

Research by InfoQuest shows sports betting has become the most popular type of betting, based on a survey of 300 gamblers.

Lottery remains the most popular, with three-quarters of respondents involved in this type of gambling. The frequency of lottery tickets purchased for the survey group was nine a month.

Read: Online betting market explodes to twice the size of casinos

Gambling surge threatens youth financial stability

Some 62% of respondents are regular online bettors, with 11 bets placed on average per month, while 52% participate in sports betting, with an average of 12 bets per month.

Among the reasons cited for gambling, 25% said “I need extra money and hope that I will win,” while 21% believed a big payout would change their family’s life.

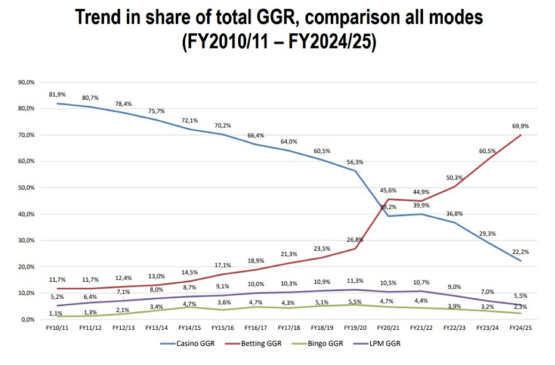

What’s also clear from the Gambling Board’s data is that casinos’ share of the gambling market has been gobbled up by betting.

Also not reflected in these graphs is turnover from all modes of gambling. This came to a staggering R1.14 trillion in 2024, according to National Gambling Board stats, up from R815 billion the prior year – an increase in 40% in a year.

As this excellent investigative piece by amaBhungane makes clear, this R1.14 trillion is not extracted from the economy. This is a turnover figure, of which about 95% is paid out in winnings, the remaining 5% being retained by the house. The house ‘edge’ will vary from one operator to another, with winnings sufficiently attractive to keep the punter involved.

‘Putting strain on household finances’

The situation was dire enough for Famous Brands to warn of the danger of online gambling to consumer spending in its 2025 annual report:

“The rise of online gambling has emerged as a significant concern for consumer spending patterns in South Africa. Platforms such as sports betting apps are capturing a growing share of discretionary budgets, particularly among lower- to middle-income households, leading to reduced footfall at quick-service restaurants. This shift represents a structural challenge to our sector, as it competes directly with affordable entertainment and social outings, further straining household finances amid high inflation and unemployment.”

Capitec also warned about the surge in online gambling last year.

It’s clear that Covid sparked the online gambling boom, with massive marketing spend by companies like Betway and Hollywoodbets fanning it into the giant it is today.

Read: Online betting advertising spend soars

Analysis by amaBhungane suggests Betway’s South African operations may account for a third of SA’s entire betting industry.

It is owned by New York Stock Exchange-listed Super Group and counts several South Africans among its key executives and shareholders. One of these is Martin Moshal, who is reckoned to have indirect control of 45% of the group through a trust.

Legislative intervention?

Though gambling regulation has the ostensible purpose of shielding the public from harm, the existing National Gambling Act of 2004 appears woefully unprepared for the recent explosion in online gambling.

Various amendments and regulations have been proposed over the years to curb what has clearly become a national problem, mostly involving restrictions on advertising – but none have been translated into law.

This has prompted speculation of lobby money interfering in what many now see as a national crisis.