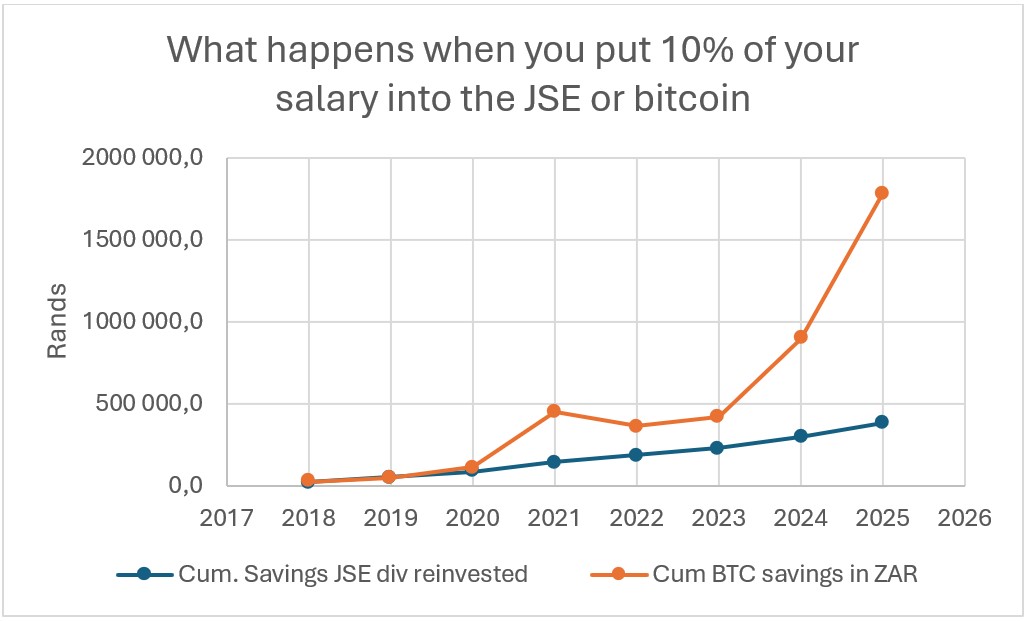

Based on an average South African salary, an investor would be close to R2 million since 2018. From Moneyweb.

Putting 10% of an average South African monthly salary – currently R28 300 – into bitcoin (BTC) since 2018 would have put the investor in the millionaire class.

Starting in January 2018, pumping 10% of the then-average salary of R20 540 each month into bitcoin, would have netted the investor an amount close to R1.8 million.

Investing that same 10% over the same period into the JSE All Share index, and reinvesting dividends, would have resulted in a portfolio worth R383 000.

The average salaries are based on Statistics SA figures since 2018.

Bitcoin’s meteoric rise from $13 800 in January 2018 to $118 100 last week, represents a gain of about 755%. This reflects bitcoin’s vaunted status as a ‘digital gold’ hedge against local challenges like a weakening rand, which has depreciated roughly 5% a year against the US dollar.

BTC is up nearly 180% since the start of 2024, when spot exchange-traded funds (ETFs) were permitted in the US, allowing institutions to start accumulating more than $152 billion in assets under management. This is nearly three times the $55 billion in net inflows since January 2024 to bitcoin ETFs, which allow institutions to invest through traditional broker accounts, bypassing the complexities of crypto wallets.

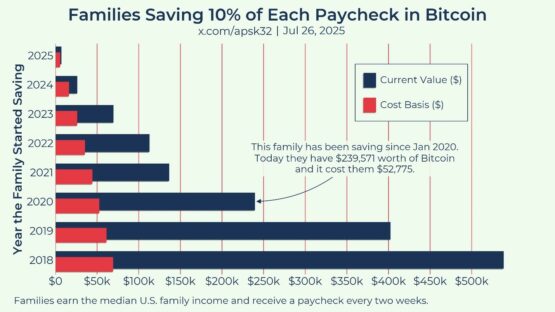

The table below shows what would have happened using the same methodology – placing 10% of the average US family income into bitcoin.

“It’s clear that bitcoin continues to outperform the market as an inflation hedge and asset class,” says Shiven Moodley, macro strategist at financial services and technology company 80eight. “I’ve been a big believer of dollar-cost-average investing with bitcoin, which is included in my strategy and (how) I show my family members how to get into crypto.”

There are volatility risks in adopting a strategy such as this, adds Moodley, and this may not be for anyone not prepared to stomach 60% to 70% drawdowns in the bitcoin price, as has happened since 2018. However, the strategy has shown itself to be workable over any five- to six-year period over the last 15 years.

The JSE is far less volatile and has enjoyed growth in each of the last seven years, except 2018.

The JSE continues to fight a shrinking market as the economic landscape remains unfavourable to bigger players, as seen by delistings in the past five years and limited initial public offerings in recent times, says Moodley.