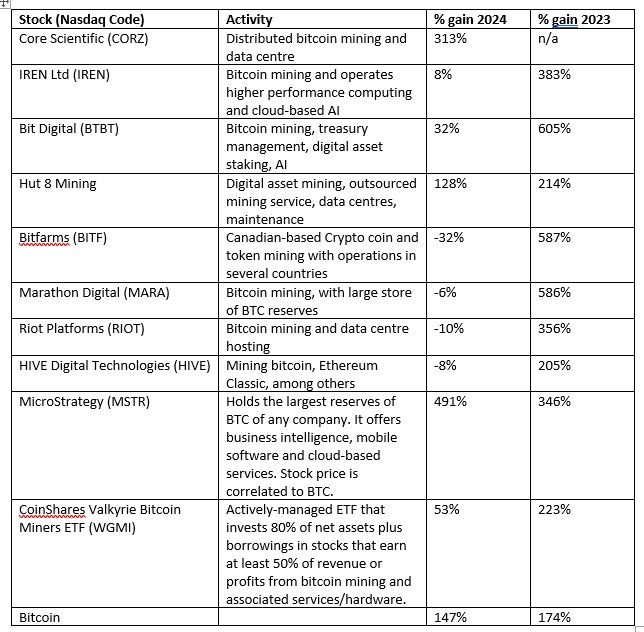

With a few exceptions, such as MicroStrategy and Core Scientific. From Moneyweb.

You were better off buying bitcoin (BTC) than bitcoin miners in 2024, a reversal of the trend in 2023.

The chart below shows bitcoin’s performance versus CoinShares’s Valkyrie Bitcoin Miners ETF, which includes close to 20 miners, though several of these companies have diversified into high-performance computing and AI as a way to keep investors interested.

It was a relatively tough year for miners after a spectacular 2023.

Star performer

The star performer over the last two years was MicroStrategy (MSTR), captained by bitcoin evangelist Michael Saylor. Its stock price is up nearly 1 987% since the start of 2023. Saylor turned the company into a bitcoin treasury, investing all surplus cash from the company’s core business of business analytics – plus billions of dollars in borrowings – into bitcoin holdings. Buying MSTR is a way for institutions to gain access to BTC by proxy since it owns shares in the company and not BTC itself.

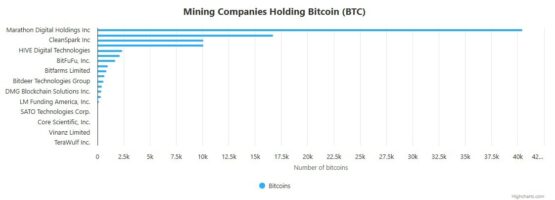

MSTR is the largest corporate holder of BTC in the world, with 461 000 coins as of January 2025, currently valued at about $47 billion. Its average purchase price is $62 473, against the current BTC price of $102 000.

That’s $47 billion in BTC alone for MicroStrategy. The company has a market cap of $84.4 billion, a 14-fold increase over its 2021 valuation.

Saylor’s massive bet on bitcoin has been variously described as a stroke of genius or madness – depending on where the market sits. Right now, he does indeed look like a genius. Investors are prepared to pay a premium for MSTR because of its stated goal of continuing to plough more cash and borrowings to increase its BTC holdings, which Saylor sees as the future of money.

If BTC’s volatility isn’t enough for you, MSTR is heavily geared to bitcoin and outperformed it in each of the last two years. In bear markets, expect a severe dip in share price.

Overall, bitcoin miners had a tough year in 2024, with seven of the 25 publicly traded miners delivering positive returns. We’ve included a snapshot below.

Bitcoin is up 174% and 147% in each of the last two years. Another miner that outperformed BTC last year was Core Scientific (CORZ), which does distributed bitcoin mining and operates data centres.

Iris Energy (IREN) had a spectacular 2023 when it delivered a stock price gain of 383% but managed just 8% in 2024. In December last year, it announced a major increase in its mining capacity and mined 529 BTC in that month. Like many others in this space, it is stocking up on Nvidia processors and expanding into high-performance computing and AI.

How bitcoin stocks have performed against BTC

The April 2024 halving event (the rewards for mining BTC are halved every four years) reduced block rewards for miners, which means lower revenues.

Mining difficulty, which is built into the bitcoin protocol to ensure scarcity, increased 50.7%.

On top of that, there were increases in operational costs, which forced miners to raise more than $2 billion for cash flow.

Miners pivot

Brian Dobson, an analyst at Clear Street, says bitcoin miners are trying to pivot to other arenas, like high-performance computing, to retain investor interest.

There are broadly two kinds of miners – those that mine and hold BTC in reserve, such as CleanSpark and Marathon Digital, and those that sell at least a portion of the coins mined to generate cash flow.

CleanSpark runs an efficient mining fleet and is exploring ways to generate yield on its hold portfolio, effectively lending their coins to earn 2-3% a year. This is going to be a new source of revenue for miners going forward.

According to Dobson, bitcoin miners that show promise are Bit Digital, CleanSpark, TeraWulf, and Bitfarms. TeraWulf is among the favourites of the analysts covering this stock, having bet big on higher-performance computing data centres alongside its bitcoin mining operations. Bitfarms is diversifying into AI data centre operations to sustain operations over the longer term when bitcoin mining is expected to taper off.

Currently, BTC miners can’t take their coins to an exchange-traded fund (ETF) and receive shares in return. This may change under the new US Securities and Exchange Commission administration, allowing miners to earn yields on their BTC reserves.

“Historically, there has been a strong correlation between the price of bitcoin and the valuations of bitcoin mining companies,” says investment firm VanEck.

“Bull market cycles in bitcoin typically provide a tailwind for mining companies as their margins increase on every mined coin. However, the opposite is true when prices become depressed, leading to more limited profitability. This pattern outlines the high beta between the asset itself and the companies who mine it.”

Worries

Are there worries on the horizon? Sure, the possibility of onerous crypto regulations and loss of confidence in the coin. But these are low-probability events.

The mining difficulty (hashrate, which automatically increases as more miners enter the space) will probably not increase much above current levels. There’s a backlog in demand for high-performance miners, so those that hold mined BTC in reserve will likely start to see the benefit of this strategy over the next two years.