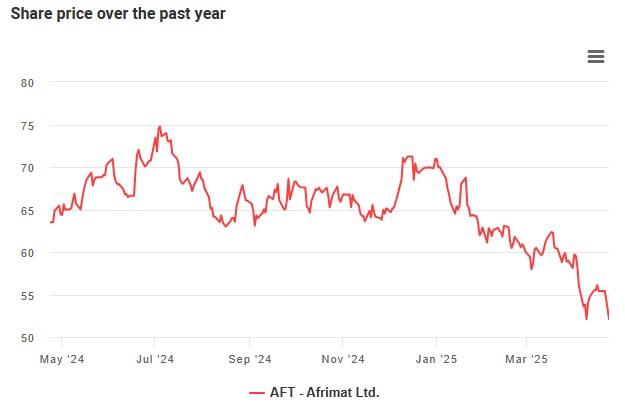

On expectations of 85-90% drop in earnings. From Moneyweb.

Afrimat’s share price plunged more than 8% on Wednesday on news that earnings per share (EPS) is expected to be 85-90% lower for the year to February 2025.

Headline EPS are expected to drop a similar amount to between 56.7c and 85.1c according to the trading update.

This comes on top of an 80% drop in headline EPS for the six months to August 2024.

Afrimat, a mid-tier mining and materials company with a market cap of about R8 billion, says the downturn in earnings was not entirely within its control.

It cites lower iron ore offtake by ArcelorMittal (Amsa), as well as losses in its recently-acquired cement business and a weaker-than-expected performance in its anthracite operations.

Read: ArcelorMittal SA’s perfect storm of woes

Lower rand receipts on iron ore exports in the first half of the financial year, and lower demand from the troubled ArcelorMittal steel producer, weighed heavily on the financial performance.

Iron ore exports volumes were 20% below its allocated rail capacity, while local iron ore sales contracted 70% in the first quarter of the year due to shrinking demand from Amsa.

Iron ore volumes improved from the second quarter, while Afrimat says it is in discussions with Amsa to supply it with innovative raw material solutions “to support their long-term sustainability.”

No anthracite was exported in the latter half of the financial year from its Nkomati mine in Mpumalanga due to the closure of the Mozambique border due to post-election violence.

Read: Mozambique election unrest is costing SA R10m a day in trade disruption

The border has since been reopened and Afrimat has secured commitments for up to 80% of the next financial year’s export volume.

Analyst views

“The iron ore price is close to 40% down since the start of 2024, and that’s primarily what led to this decline in EPS at Afrimat,” says Kea Nonyana, market analyst and head of Scope Prime Africa.

“It’s now clear that the downstream effects of ArcelorMittal’s proposed closure of its long steel mills has impacted Afrimat’s iron business.

“That said, we are starting to see green shoots in bulk commodities and the successful bedding down some of their acquisitions, such as the Lafarge cement business,” says Nonyana.

“They want to diversify away from bulk commodities and start investing in infrastructure build as shown by their recent acquisition of Lafarge. Overall, it’s not a great result, and it’s primarily because of what is happening in iron ore.”

Listen/read: The acquisition of Lafarge ‘a wonderful deal’ for Afrimat

One analyst points out that R400 million of Lafarge’s R900 million loan book that Afrimat assumed as part of the R1 billion acquisition is now falling due. While this loan is interest-free, it places cash strain on the company.

The deal was nevertheless struck at less than Lafarge’s book value of R1.3 billion.

Afrimat says the integration of Lafarge into its construction materials business unit has been completed and will show a better result than last year when an after-tax loss of R116 million was reported for the new cement business.

By August 20204, debt-equity had increased to 45.6% from just 1.4% in February 2024 due to the Lafarge and R305 million Glenover phosphate and rare earth transactions.

The industrial minerals business has recovered, helped by the suspension of load shedding and improving signs for the economy.

The future materials and metals business, made up of phosphate and rare earth elements centred in Limpopo, appears to be progressing, with testing on rare earth components nearing completion and showing positive results. The phosphate plant is now operational, with ramp-up progressing well, although slower than projected.

Listen/read: ‘Bomb Squad’ stocks: Afrimat vs JSE

Afrimat management says it is confident that the majority of metrics have turned the corner and a better year ahead is expected.

The Nkomati mine has been adapted for flexible mining, margins are improving in the construction materials business, and losses are being reduced in the cement business.