Precious metals are driving the JSE to new highs, but this does not reflect what’s really happening in SA, where businesses are labouring. From Moneyweb.

Gold came within a whisker of $3 900 an ounce this week, powering precious metal stocks to dizzying levels.

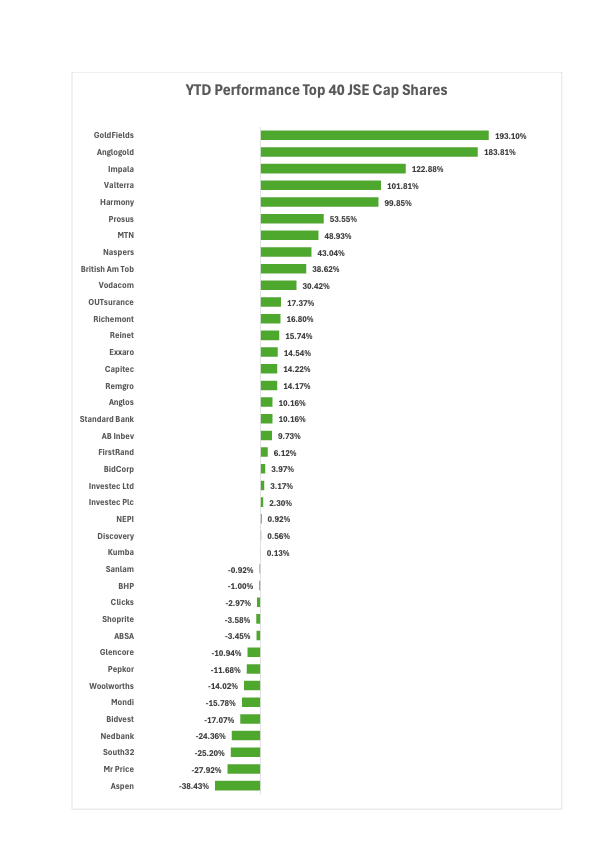

AngloGold Ashanti is up 194% year to date, Gold Fields 193%, and Harmony 103%.

The irony is that AngloGold no longer has any mines in SA. Gold Fields has one, at South Deep.

Also crowding the list of the year’s best performers are Impala (up 159%) and Valterra, formerly Anglo Platinum, which has risen 120% since January.

These are the stocks that have driven the JSE All Share Index, which is up 29% so far this year.

Can the gold stock rally last? Many believe it can.

JPMorgan expects gold prices to average $3 675/oz by the fourth quarter of 2025 and climb toward $4 000 by mid-2026. That said, gold prices have exceeded most forecasts in 2025, so these projections could turn out to be conservative.

Gold miners – the smart ones – assume that disaster is just over the horizon. They hoard cash in the event that their assumptions prove correct. By hoarding cash, they are in a continual war against costs. They also need cash as a war chest for new opportunities, according to an analysis by 80eight. This keeps them nimble and better able to respond to gold price shocks.

George Cheveley, global gold portfolio manager at Ninety One, believes the gold stock rally still has legs, after coming away from meeting 30 gold companies at the recent Mining Forum Americas. “Cost control remains a priority for most companies, which are keen to prove to investors that they can convert record margins into cashflows,” says Cheveley.

As gold prices have gone up, so too have tax and royalty payments, but miners are using their strong earnings to support their campaigns to muzzle cost pressures.

Many are bringing contract miners inhouse to reduce operating costs and using cash, rather than more expensive debt, to fund new projects.

Read:

Goldman says mining stocks to help drive South African equities

Bulls expect gold to top $3 000 in 2025

Another theme Cheveley highlights is the unrelenting focus on cash – to the point where miners are loath to reduce cut-off grades (the minimum concentration of gold for mining to be considered worthwhile) to extend mine life, for fear this would increase unit costs.

“Instead, increasing dividends and/or buybacks generally remains the focus, which is positive for shareholder returns,” Cheveley adds.

Generalist investors are now entering the market, a marked change from the early 2020s, when gold investments were largely confined to the specialists.

As mining companies are often valued based on their reserves, this is critical on a forward view of the market. A distinction must be made between those with sufficient reserves and those with limited or fast-depleting reserves. Exploration budgets are rising as miners seek to discover new deposits and establish whether existing resources remain viable for mining.

“Expanding mining activity can be good for company earnings and shareholder returns,” says Cheveley.

“However, it also risks lowering average grades and hence increasing costs, which can drag on profitability. The good news is that better software now exists to help companies process the large amounts of data on which such decisions rest, hopefully resulting in better outcomes.”

David Shapiro, chief global equity strategist at Sasfin Securities, points to the following chart as proof that the JSE is really a story of two markets: precious metals are driving gains, while retailers and banks are labouring.

“I think the easy money has been made on gold. Gold has run on the weak dollar and the wish of certain countries to spread their reserves beyond the dollar,” says Shapiro.

“Remember, gold produces no yield, so there are limits to how much gold central bankers and investors can hold. I always remember when I first joined the market, I was told: you buy gold in a bull market and wait for the next bull market to get your money back.”

Read: Gold punters are ahead in Shapiro’s share challenge

Gold could edge higher, but not for long, since the US dollar’s current weakness starts to reverse, adds Shapiro.

The US, as the world’s largest economy, may face further interest rate cuts, which would further weaken the dollar, and this could boost gold – for a while.

“As the US economy picks up, the massive speculative positions in gold – and subsequently platinum – will unravel,” says Shapiro. “Gold is not AI; it’s not a driver of growth or investment. It’s a piece of metal that remains the same piece of metal over centuries. Eventually, people tire of holding it. I’ve watched its performance over decades.”

Cheveley believes mergers and acquisitions (M&A) could also drive value in gold mining, although this has become more challenging now that gold prices have scrambled higher. “The outlook for gold prices and gold equities appears increasingly positive. However, with reserves and M&A potential among the key differentiators between gold miners, a selective approach is strongly advised.”

Gold shares have an advantage over many other types of companies in the form of operating leverage, says Kea Nonyana, VIP client manager at PrimeXBT. This means that higher gold prices translate immediately to the bottom line. “These counters will continue to do well if the gold price remains at elevated levels. Political uncertainty in the US with the tariff wars and government shutdown, coupled with the fact that the interest rate futures predict two more rate cuts in the upcoming meetings, I don’t see any reason on the horizon for the gold price to retreat from these levels. I believe this is just the start of the bull run of gold stocks.”

Read: Gold’s record surge: Boom, bust, or just the beginning?

Investing in gold shares takes the kind of cast-iron stomach that crypto enthusiasts have cultivated. It can be exhilarating, but be prepared for a bumpy ride should the gold price start giving up some of its gains.